Crowdfunding an Investment in Life-Saving Technology

A Revolutionary Breakthrough

in Skin Cancer Detection

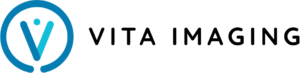

Vita Imaging, Inc. is a medical device company developing cutting-edge cancer detection and diagnostic technology. The company’s lead product, AURA™, is a licensed, patent-protected diagnostics platform technology. The AURA™ device is capable of identifying both melanoma and non-melanoma skin cancers in 1.5 seconds.

AURA’s™ FDA review is in its final stages and targeted for completion in 2024. To expand its global market reach, Vita Imaging will also seek regulatory approval in additional markets including Canada, the European Union (EU), Australia, India, and Asia.

Reasons to Invest in This Crowdfunding Opportunity

AURA™ is currently in its pre-revenue stage of development. Vita Imaging has applied to the FDA for market clearance for AURA™ and anticipates completion of the regulatory process during the first half of 2024. Vita Imaging’s multidisciplinary scientific, medical, and technical team includes world-renowned experts in cancer detection. The company’s CEO is a Stanford engineering graduate with a track record of taking a start-up high-tech company public on the NASDAQ, achieving a market cap of over $2 billion.

Cancer is a word we instinctively fear.

Many of us have known someone afflicted with cancer. We see celebrity cancer deaths on the news. And unfortunately, some of us have been cancer victims ourselves.

Fears of death, disability, and a loss of control over life are easy to understand. A cancer diagnosis can seriously undermine mental health and wellbeing[2] – and impact the emotional health of families and caregivers.[3]

In the United States, cancer is the second leading cause of death.[4] Cancer is also a top cause of death globally, accounting for around 1 in every 6 deaths.[5]

The Startling Truth About Skin Cancer

Skin cancer is the most common form of cancer in the U.S., costing the healthcare system $8.1 billion annually.[6] This places a heavy economic burden on our society.

In the U.S. alone, an estimated 9,500 people are diagnosed with skin cancer each day. One in every five people will develop skin cancer by the age of 70.[7]

An aggressive form of skin cancer called Merkel cell carcinoma recently claimed the life of beloved singer-songwriter Jimmy Buffett.[8] While rare, about 3,000 Americans die of this cancer each year.[9]

The two most common forms of skin cancer are basal cell and squamous cell carcinomas.

Fortunately, both of these cancers are highly curable – if detected early and treated properly.[10]

The skin cancer called melanoma is often called “the most serious skin cancer” in large part because it has a tendency to spread.[11]

Because malignant melanoma can be deadly, surgical treatment involves a wide excision of skin around the tumor. This can result in scarring or disfigurement, especially with surgery to the face, head, or neck.[12]

The Good News and the Bad News About Melanoma

Melanoma is responsible for the vast majority of skin cancer deaths. In 2022, about 7,650 deaths were attributed to melanoma in the U.S.[13]

There is some good news…

According to the American Cancer Society, the 5-year survival rate for melanoma is 99% – when detected early.[14]

The bad news?

Unfortunately, the 5-year survival rate for metastatic melanoma (Stage IV) plunges to only 22.5%.[15]

This means that early detection represents a truly life-saving measure.

Melanoma rates in the United States have continued to rise, particularly in the older age group. Around 1 in 27 men and 1 in 40 women in the U.S. will develop melanoma during their lifetime.

Considering these facts, it’s no wonder the U.S. Department of Health and Human Services identified skin cancer as a major threat to public health.[16]

With this warning, the Surgeon General’s Call to Action to Prevent Skin Cancer established skin cancer prevention, monitoring, and evaluation as a high priority for this country.[17]

Heeding this call to action, Vita Imaging believes there is an urgent need for its revolutionary skin cancer detection tool called AURA™.

This specialized device was designed to improve diagnostic accuracy and significantly reduce the need for invasive, costly, and often unnecessary biopsies.

AURA™ works by utilizing proven Raman spectroscopy technology that can differentiate between benign and malignant lesions, providing nearly instantaneous results.

To really understand the breakthrough nature of AURA™, it’s important to first get a sense of the nearly antiquated detection practices used today.

Visual Lesion Inspection is Subjective and Error-Prone

Unfortunately, most healthcare providers still rely on visual inspection of suspicious lesions. However, the accuracy of the clinical diagnosis of cutaneous melanoma with the unaided eye is only about 60%.[18]

To improve accuracy, many clinicians use a tool called a dermatoscope.

Dermatoscopes have been described as “skin microscopes.” They are essentially hand-held visual aid devices that use a bright light and a magnifying glass to help physicians identify potential skin lesions.[19]

Unfortunately, even in trained hands, melanomas can be missed by dermoscopy, especially if melanoma features are not noted on the periphery of the lesion.[20]

We need a better way of detecting skin cancers – and catching them early.

Biopsies are Inaccurate, Subjective, and Often Unnecessary

No doctor wants to miss a potentially dangerous skin cancer. This issue with diagnostic accuracy leads many physicians to excise or biopsy lesions as a precautionary procedure.

These biopsies cost an estimated $1.6 billion annually.[21] Yet research found that 95% of suspicious lesions were benign or premalignant.[22] This can be frustrating and problematic for both insurers and patients.

Wouldn’t it be better to accurately detect and differentiate malignant versus non-malignant lesions before getting to the biopsy stage?

Introducing AURA™ Technology – Proven Superior to Traditional Detection Methods

Medical device company Vita Imaging knows that objective and reliable diagnostic tools are crucial in the fight against the skin cancer epidemic.

The AURA™ skin cancer detection device was designed by leading scientists and physicians at the renowned British Columbia Cancer Agency and the University of British Columbia.

In fact, over 20 years of research and development have been done.

And $20 million has already been invested to commercialize AURA™.

The AURA™ device uses proven Raman spectroscopy technology that can differentiate between benign and malignant lesions.

It works by identifying unique changes associated with the biochemistry of skin cancer cells. Using a scattering of light molecules, the way the light reflects back creates a “molecular fingerprint” that can differentiate between cancerous and non-cancerous molecules.

What’s more, it works within 1.5 seconds!

This means that, nearly instantaneously, the data generated by AURA™ can help physicians make informed decisions regarding diagnosis and treatment.

Because it aids physicians in determining if biopsy is needed, AURA™ has the potential to improve patient outcomes and reduce the need for unnecessary biopsies.

With clinical testing conducted at Vancouver General Hospital, AURA™ was used in a patient study spanning six years with over 800 patients – including the assessment of over 1,000 lesions. To date, it is the most comprehensive Raman spectroscopy-based skin cancer study conducted globally.

The latest clinical study results, published in a peer-reviewed journal, showed over all sensitivity of 99.% and specificity of 44.5% in identifying patients with skin cancers. These performance results are markedly superior to other devices on the market.

AURA™ has successfully passed all product performance and safety tests.

Through this process, the company has demonstrated that AURA™ exceeds all FDA benchmarks, paving the way for full clearance and commercialization as a Class 3 medical device.

An earlier version of the AURA™ device previously achieved market clearance in Canada, the European Union, and Australia.

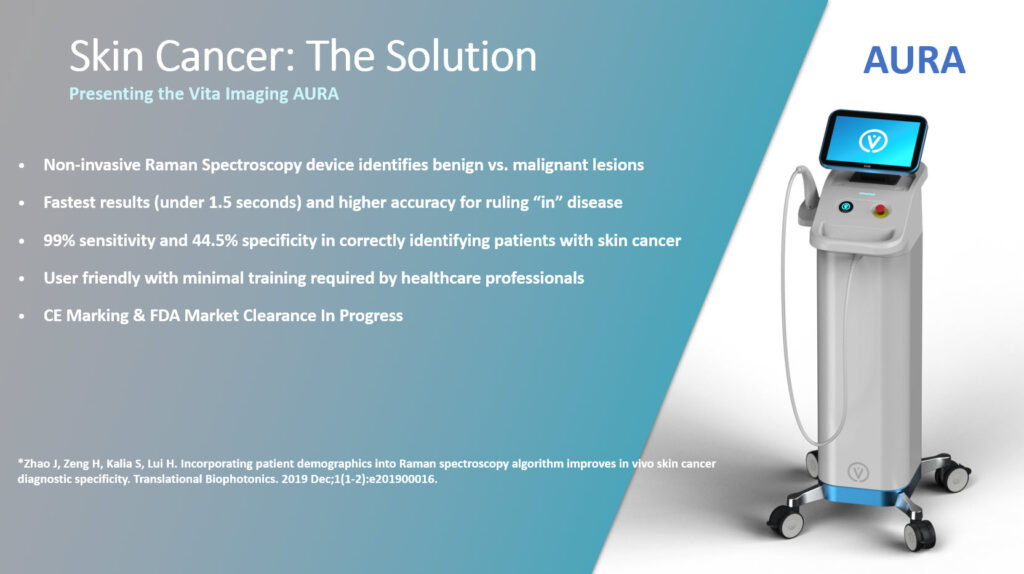

AURA™ testing is also non-invasive and requires little training to use.

Unlike some other devices, no skin preparation is required.

This means it can be quickly and easily deployed in any dermatologist’s office.

AURA™ also offers integrated data management software that allows users to store patient records securely in one place. Its compact design makes it highly portable, and it easily fits in any clinical setting without requiring added space or setup time.

Additional target customers for the AURA™ device include general practitioners, primary care physicians, skin clinics, medical spas, and other settings. The company anticipates that nurses and technicians will be able to perform the screenings under physician supervision.

Billing code application is also in process to provide for insurance reimbursement.

AURA™ also supports a recurring revenue model. In addition to sales of the device itself, the company anticipates gaining revenue from:

- Sales of disposable probe tips (one per patient) needed to ensure calibration and prevent cross-contamination

Service contracts based on the industry standard of charging customers annually the equivalent of 10% of the original sales price of the device

Additionally, Vita Imaging intends to collect valuable spectral data of AURA™ lesion scans to build a comprehensive spectral imaging database with AI/machine learning to help increase accuracy even further.

A Growing Market for Skin Cancer Diagnostics

Increasing rates of skin cancer have created a growing diagnostics market.

Globally, the skin cancer diagnostics market generated $3.3 billion in 2021, and is expected to reach nearly $5.5 billion by 2028.[23]

Future Plans for Expansion and a Robust Patent Portfolio

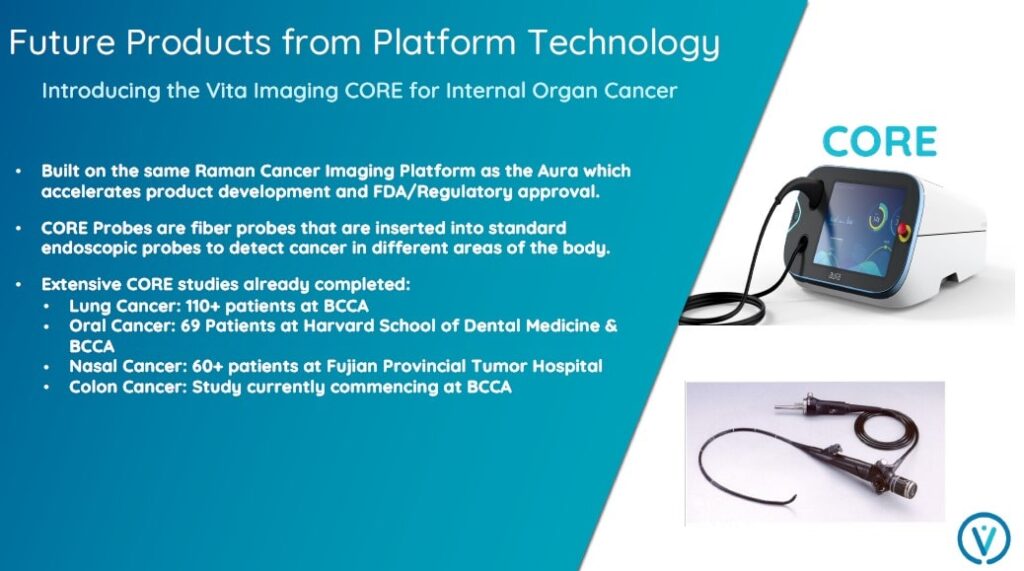

Vita Imaging anticipates future revenue opportunities detecting other types of cancer, including those affecting the lung and colon. For internal organ cancers, CORE probes inserted into standard endoscopic probes will be used.

Because they are based on the same Raman cancer imaging platform as the AURA™ device, the company believes that CORE product development and FDA/regulatory approval can be accelerated.

As you can see below, multiple CORE studies have already been completed, encompassing multiple types of cancer.

In addition, the company already has a robust intellectual property portfolio.

Through its partnership with the British Columbia Cancer Agency and the University of British Columbia, Vita Imaging has licensed a comprehensive patent portfolio to a cutting-edge platform technology with applications for cancer detection in the skin (AURA™) as well as internal organs.

The company has flourished under the leadership of Chairman and CEO Thinh Quy Tran, a seasoned CEO who has experience turning a start-up into a billion-dollar publicly traded NASDAQ company.

You can view the full leadership team below, along with the scientific, inventor, and clinical partners and the company’s regulatory expert/consultant.

Leadership

Thinh Tran

Chairman / CEO

Prior to Vita Imaging , Thinh was the Founder, CEO, & Chairman of V-Silicon, a leader in the Smart TV market delivering best in class picture and audio quality. He was previously the Founder, Chairman, & CEO of Sigma Designs since its inception in 1982 – which he built from a humble start-up into a two billion dollar publicly traded NASDAQ company – making him one of the longest serving CEOs on the NASDAQ. He also has extensive experience raising capital, executing M&A transactions, and providing guidance to many start-ups. Prior to Sigma Designs, He was employed by Amdahl Corporation and Trilogy Systems Corporation, leaders in the IBM mainframe computer market. He holds a B.S.E.E. from the University of Wisconsin & M.S.E.E. from Stanford University.

Victoria Reade

Chief Operations Officer / COO

Ms. Reade has 25+ years of executive leadership and consulting experience including Scripps Clinic Medical Group & Green Hospital La Jolla, Hospitals, Payer/HMOs, Big 4 Consultant (Healthcare & IT), Pharma and medical device companies. Previously, she was the Founder and CEO of a medical device & biologics company where she successfully secured FDA 510(k) device approval; served as CEO & Chief Administrative Officer (CAO) of a 157 bed acute care hospital; Director of a Clinical Research site in San Francisco conducting Phase 1 to 3 Pivotal Studies; and led pre-clinical Studies for a UK based Stem Cell and Regenerative Medicine company at Harvard Schepens & UCSD. Ms. Reade holds an MBA from Pace University, a Bachelor of Science Nursing (BSN) from University of Tennessee Center for Health Sciences, and NY & CA RN license.

Dzung Wright

Interim CFO

Dzung is the interim Chief Financial Officer of Vita Imaging, Inc. She has over 30 years of experience in the financial industry, holding senior financial positions at multiple publicly traded and startup companies over a wide range of industries such as medical, telecommunications, device technology, digital arts, mobile devices, and internet technology.

Before joining Vita Imaging, Dzung held senior finance roles at Vivus Inc., Controlnet Inc., Foneweb Inc., and Microlambda Wireless Inc. She has a proven track record of success in leading and managing financial teams, and she has a deep understanding of financial reporting, analysis, and planning.

Dzung is a graduate of San Jose State University and holds a Bachelor’s degree in Business Administration and Accounting.

Thinh Tran

Chairman / CEO

Prior to Vita Imaging , Thinh was the Founder, CEO, & Chairman of V-Silicon, a leader in the Smart TV market delivering best in class picture and audio quality. He was previously the Founder, Chairman, & CEO of Sigma Designs since its inception in 1982 – which he built from a humble start-up into a two billion dollar publicly traded NASDAQ company – making him one of the longest serving CEOs on the NASDAQ. He also has extensive experience raising capital, executing M&A transactions, and providing guidance to many start-ups. Prior to Sigma Designs, He was employed by Amdahl Corporation and Trilogy Systems Corporation, leaders in the IBM mainframe computer market. He holds a B.S.E.E. from the University of Wisconsin & M.S.E.E. from Stanford University.

Victoria Reade

Chief Operations Officer / COO

Ms. Reade has 25+ years of executive leadership and consulting experience including Scripps Clinic Medical Group & Green Hospital La Jolla, Hospitals, Payer/HMOs, Big 4 Consultant (Healthcare & IT), Pharma and medical device companies. Previously, she was the Founder and CEO of a medical device & biologics company where she successfully secured FDA 510(k) device approval; served as CEO & Chief Administrative Officer (CAO) of a 157 bed acute care hospital; Director of a Clinical Research site in San Francisco conducting Phase 1 to 3 Pivotal Studies; and led pre-clinical Studies for a UK based Stem Cell and Regenerative Medicine company at Harvard Schepens & UCSD. Ms. Reade holds an MBA from Pace University, a Bachelor of Science Nursing (BSN) from University of Tennessee Center for Health Sciences, and NY & CA RN license.

Dzung Wright

Interim CFO

Dzung is the interim Chief Financial Officer of Vita Imaging, Inc. She has over 30 years of experience in the financial industry, holding senior financial positions at multiple publicly traded and startup companies over a wide range of industries such as medical, telecommunications, device technology, digital arts, mobile devices, and internet technology.

Before joining Vita Imaging, Dzung held senior finance roles at Vivus Inc., Controlnet Inc., Foneweb Inc., and Microlambda Wireless Inc. She has a proven track record of success in leading and managing financial teams, and she has a deep understanding of financial reporting, analysis, and planning.

Dzung is a graduate of San Jose State University and holds a Bachelor’s degree in Business Administration and Accounting.

Scientific, Inventor & Clinical Partners

Haishan Zeng, PhD

Distinguished Scientist & Lead Inventor

Dr. Zeng is a Distinguished Scientist with the Integrative Oncology Department (Imaging Unit) of the BCCA & Professor of Dermatology, Pathology, and Physics at UBC. He has 170+ Peer Reviewed Publications and 28+ patents related to optical diagnosis and therapy. Dr. Zeng holds a PhD in Biophysics from UBC and is the lead Inventor of the Rapid Raman Spectroscopy Platform Technology developed at BCCA, including the AURA™ and CORE.

Harvey Lui, MD, FRCPC

Lead Principal Investigator & Co-Inventor

Dr. Lui is a Professor and former Head of the Department of Dermatology and Skin Science at UBC. He was formerly the President of the International League of Dermatological Societies, an active member of the Photomedicine Society, and Canadian Dermatology Association, amongst other medical organizations. Dr. Lui received his MD from UBC and completed an advanced fellowship at Massachusetts General Hospital and Harvard Medical School.

Sunil Kalia, MD, FRCP

Principal Investigator

Dr. Kalia is co-Director of the Psoriasis & Phototherapy Clinic at Vancouver General Hospital and Assistant Professor in Dermatology at UBC. He is President of the Dermatology Society of British Columbia & Board Director, Dermatology. Dr. Kalia is a graduate of the University of Calgary and has a Masters in Healthcare & Epidemiology and completed photo dermatology training in the USA, Australia, Europe.

Michael Short, PhD

Scientific Collaborator & Co-Inventor

Dr. Short has been a Research Associate at BCCA for over 12 years. He is the Lead and/or co-author of 31 scientific papers in peer reviewed journals featuring medical applications for Raman spectroscopy. He is a named co-inventor on 6 Raman Spectroscopy patents. He holds a PhD in Physics from Simon Fraser University in Canada.

Jianhua Zhao, PhD

Scientific Collaborator & Co-Inventor

Dr. Zhao is a Research Associate at BCCA and UBC. He has published 90+ scientific papers and has 5+ patent applications based on his specialized work in Raman Spectroscopy, diffuse reflectance, and fluorescence for skin cancer diagnosis. He holds a PhD in Optical Engineering from Shandong University in collaboration with University of California Santa Barbara.

Barry Lycka, MD, FRCPC

Physician Advisor

Dr. Barry Lycka has over 25 years experience as one of the most respected and accomplished cosmetic dermatologists in the world performing Mohs surgery and other elaborate procedures. He was an early adopter of AURA™ which he used successfully until he retired in 2019. He has written 17 books, over 30 academic papers and hosted one of the number one internet radio shows on cosmetic surgery. Dr. Lycka is a graduate of the University of Alberta, Edmonton, Canada medical school. He is a member of the American Board of Dermatology and the Fellowship Royal College of Physicians of Canada.

Haishan Zeng, PhD

Distinguished Scientist & Lead Inventor

Dr. Zeng is a Distinguished Scientist with the Integrative Oncology Department (Imaging Unit) of the BCCA & Professor of Dermatology, Pathology, and Physics at UBC. He has 170+ Peer Reviewed Publications and 28+ patents related to optical diagnosis and therapy. Dr. Zeng holds a PhD in Biophysics from UBC and is the lead Inventor of the Rapid Raman Spectroscopy Platform Technology developed at BCCA, including the AURA™ and CORE.

Harvey Lui, MD, FRCPC

Lead Principal Investigator & Co-Inventor

Dr. Lui is a Professor and former Head of the Department of Dermatology and Skin Science at UBC. He was formerly the President of the International League of Dermatological Societies, an active member of the Photomedicine Society, and Canadian Dermatology Association, amongst other medical organizations. Dr. Lui received his MD from UBC and completed an advanced fellowship at Massachusetts General Hospital and Harvard Medical School.

Sunil Kalia, MD, FRCP

Principal Investigator

Dr. Kalia is co-Director of the Psoriasis & Phototherapy Clinic at Vancouver General Hospital and Assistant Professor in Dermatology at UBC. He is President of the Dermatology Society of British Columbia & Board Director, Dermatology. Dr. Kalia is a graduate of the University of Calgary and has a Masters in Healthcare & Epidemiology and completed photo dermatology training in the USA, Australia, Europe.

Michael Short, PhD

Scientific Collaborator & Co-Inventor

Dr. Short has been a Research Associate at BCCA for over 12 years. He is the Lead and/or co-author of 31 scientific papers in peer reviewed journals featuring medical applications for Raman spectroscopy. He is a named co-inventor on 6 Raman Spectroscopy patents. He holds a PhD in Physics from Simon Fraser University in Canada.

Jianhua Zhao, PhD

Scientific Collaborator & Co-Inventor

Dr. Zhao is a Research Associate at BCCA and UBC. He has published 90+ scientific papers and has 5+ patent applications based on his specialized work in Raman Spectroscopy, diffuse reflectance, and fluorescence for skin cancer diagnosis. He holds a PhD in Optical Engineering from Shandong University in collaboration with University of California Santa Barbara.

Barry Lycka, MD, FRCPC

Physician Advisor

Dr. Barry Lycka has over 25 years experience as one of the most respected and accomplished cosmetic dermatologists in the world performing Mohs surgery and other elaborate procedures. He was an early adopter of AURA™ which he used successfully until he retired in 2019. He has written 17 books, over 30 academic papers and hosted one of the number one internet radio shows on cosmetic surgery. Dr. Lycka is a graduate of the University of Alberta, Edmonton, Canada medical school. He is a member of the American Board of Dermatology and the Fellowship Royal College of Physicians of Canada.

Regulatory Experts & Consultants

George DeMuth, MS

Founder & CEO, Stat One LLC & Biostatistician Expert

Mr. DeMuth is the CEO of Stat One, LLC which is a statistical consulting and data management group that provides expert support to companies seeking FDA Regulatory approval with a broad range of services including: high level statistical consulting, SAS programming and data management services. George has over 30 years of experience working as a lead statistician on clinical trials in support of pharmaceutical, medical device, and biologic products. He was the founder of a previous CRO that sold its assets in 20 I 3. Mr. DeMuth has worked with several hundred companies across numerous therapeutic areas and supported many approved products. He has attended numerous FDA meetings as the client’s representative and has presented at FDA panel meetings. Mr. DeMuth has extensive programming experience and has developed several statistical reporting packages using SAS macros. He is also the developer of Stat One EDC®, an electronic data capture system, Stat One ValTrack , a validation tracking system and Stat One TPM™, a proprietary training and project management system.

Sign Up To Receive Our Investor Deck

Invest in Life-Saving Technology Developed By Leading Scientists and Physicians

Skin cancer is a worldwide epidemic with significant health, economic, and societal consequences.

According to the World Health Organization, at least 132,000 new melanomas are diagnosed each year. And the incidence of skin cancers has risen in recent decades.[24]

To help improve these outcomes, Vita Imaging believes that the time to invest in objective, accurate skin cancer detection tools is NOW.

“Raman spectroscopy opens up a promising future in advancing

skin cancer diagnostics by enabling early detection, real-time analysis,

and integration with other diagnostic technologies. Its potential to

distinguish between different types of skin tumors further emphasizes

its significance in the domain of skin cancer diagnostics.” [25]

– Journal of Clinical Medicine, 2023

Over the next five years, the company will focus on optimizing growth and marketing outreach with a goal of deploying AURA™ technology where it is needed most – to defy cancer on a worldwide scale.

With a dynamic blend of groundbreaking innovation, strategic partnerships, and growing traction, Vita Imaging is on the brink of transforming the skin cancer detection landscape.

A prior successful crowdfunding equity campaign using the StartEngine platform raised approximately $828,000 from 582 investors.[26]

Backed by an impressive base of industry-advancing research, a comprehensive patent portfolio, and a history of successful funding, Vita Imaging is positioned to redefine the skin cancer detection market.

Seize this opportunity to be part of a journey that’s reshaping the landscape of cancer detection, bringing hope and peace of mind back to millions of people.

Thank you for investing in our mission!

PERKS

VOLUME-BASED PERKS

TIER 1 PERK: Invest $500 and receive a custom-made skin lesion ruler with logo that can be used to check your moles and see if they are changing, and 2 logo branded silicone UV wrist bands that change color in the sun as a reminder to apply sunscreen.

TIER 2 PERK: Invest $2,500 and receive the skin lesion ruler, UV wristbands, USB drive, +3% bonus shares.

TIER 3 PERK: Invest $5,000 and receive the skin lesion ruler, UV wristbands, USB drive, +5% bonus shares.

TIER 4 PERK: Invest $10,000 and receive the skin lesion ruler, UV wristbands, USB drive, +10% bonus shares.

* First Week is equivalent to Days 1-7 beginning the day this offering is launched (the “Launch Date”) through 11:59 pm Pacific Standard Time (“PST”) (06:59 am Coordinated Universal Time (“UTC”) on the 7h day following the Launch Date.TERMS

Offering Minimum:

$15,000.00 (2,632 shares of Common Stock)

Offering Maximum:

$4,120,000.00 (701,754* shares of Common Stock)

Type of Security Offered:

Common Stock

Purchase Price of Security Offered:

$5.70

Minimum Investment Amount (per investor):

$570.00 (plus 3% Transaction Fee capped at $30)

*Includes a 3% investor transaction fee on the share issuance of $4,000,000. Maximum number of shares offered subject to adjustment for bonus shares. See below.

INVESTOR EDUCATION

- Why invest in startups? Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise – you are buying a piece of a company and helping it grow.

- How much can I invest? Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

- How do I calculate my net worth? To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

- What are the tax implications of an equity crowdfunding investment? We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

- Who can invest in a Regulation CF Offering? Individuals over 18 years of age can invest.

- What do I need to know about early-stage investing? Are these investments risky? There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

- When will I get my investment back? The Common Stock (the “Shares”) of Vita Imaging, Inc. (the “Company”) are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

- Can I sell my shares? Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

- Exceptions to limitations on selling shares during the one-year lockup period: In the event of death, divorce, or similar circumstance, shares can be transferred to: The company that issued the securities An accredited investor A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships)

- What happens if a company does not reach their funding target? If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

- How can I learn more about a company’s offering? All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

- What if I change my mind about investing? You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: Info@vita-imaging.com

- How do I keep up with how the company is doing?At a minimum, the company will be filing with the SEC and posting on it’s website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

- What relationship does the company have with DealMaker Securities? Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise – you are buying a piece of a company and helping it grow.

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Individuals over 18 years of age can invest.

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

The Common Stock (the “Shares”) of [private issuer name] (the “Company”) are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

In the event of death, divorce, or similar circumstance, shares can be transferred to:

- The company that issued the securities

- An accredited investor

- A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships)

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: Info@vita-imaging.com

At a minimum, the company will be filing with the SEC and posting on it’s website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.

- Why invest in startups? Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise – you are buying a piece of a company and helping it grow.

- How much can I invest? Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

- How do I calculate my net worth? To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

- What are the tax implications of an equity crowdfunding investment? We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

- Who can invest in a Regulation CF Offering? Individuals over 18 years of age can invest.

- What do I need to know about early-stage investing? Are these investments risky? There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

- When will I get my investment back? The Common Stock (the “Shares”) of Vita Imaging, Inc. (the “Company”) are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

- Can I sell my shares? Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

- Exceptions to limitations on selling shares during the one-year lockup period: In the event of death, divorce, or similar circumstance, shares can be transferred to: The company that issued the securities An accredited investor A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships)

- What happens if a company does not reach their funding target? If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

- How can I learn more about a company’s offering? All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

- What if I change my mind about investing? You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: Info@vita-imaging.com

- How do I keep up with how the company is doing?At a minimum, the company will be filing with the SEC and posting on it’s website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

- What relationship does the company have with DealMaker Securities? Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.

Want to learn more about Vita Imaging's Breakthrough Skin Detection?

Terms & Sources

Offering Minimum: $15,000.00 (2,632 shares of Common Stock)

Offering Maximum: $4,120,000.00 (701,754* shares of Common Stock)

Type of Security Offered: Common Stock

Purchase Price of Security Offered: $5.70

Minimum Investment Amount (per investor): $570.00 (plus 3% Transaction Fee capped at $30)

* Includes a 3% investor transaction fee on the share issuance of $4,000,000. Maximum number of shares offered subject to adjustment for bonus shares. See below.

Time-Based Perks

First week 10% bonus shares.

(First Week is equivalent to Days 1-7 beginning the day this offering is launched (the “Launch Date”) through 11:59 pm Pacific Standard Time (“PST”) (06:59 am Coordinated Universal Time (“UTC”) on the 7h day following the Launch Date.)

Volume-Based Perks

Tier 1 Perk – Invest $500 and receive a custom-made skin lesion ruler with logo that can be used to check your moles and see if they are changing, and 2 logo branded silicone UV wrist bands that change color in the sun as a reminder to apply sunscreen.

Tier 2 Perk – Invest $2,500 and receive the skin lesion ruler, UV wristbands, USB drive, +3% bonus shares.

Tier 3 Perk – Invest $5,000 and receive the skin lesion ruler, UV wristbands, USB drive, +5% bonus shares.

Tier 4 Perk – Invest $10,000 and receive the skin lesion ruler, UV wristbands, USB drive, +10% bonus shares.

[1] https://www.theinsightpartners.com/reports/skin-cancer-diagnostics-market#:~:text=The%20non%2Dmelanoma%20segment%20dominated,share%20of%2052.31%25%20in%202021

[2] https://bmccancer.biomedcentral.com/articles/10.1186/s12885-019-6181-4

[3] https://www.cancer.org/cancer/managing-cancer/side-effects/emotional-mood-changes.html

[4] https://www.dhs.wisconsin.gov/publications/p01058.pdf

[5] https://www.cdc.gov/nchs/fastats/leading-causes-of-death.htm

[6] https://practicaldermatology.com/articles/2018-feb/new-nmsc-guidelines-highlight-options-and-need-for-more-research

[7] https://www.skincancer.org/skin-cancer-information/skin-cancer-facts/#:~:text=1%20in%205%20Americans%20will,for%20melanoma%20is%2099%20percent

[8] https://www.skincancer.org/blog/jimmy-buffetts-death-puts-merkel-cell-carcinoma-in-the-spotlight/

[9] https://www.skincancer.org/skin-cancer-information/?gclid=CjwKCAiAzc2tBhA6EiwArv-i6YLgG9CsPGqtHODJrzEMe7nRBwua6DPCB4aZOu6zyUvZBZI2JuJ6FRoC3jYQAvD_BwE

[10] https://www.aad.org/media/stats-skin-cancer#:~:text=The%20five%2Dyear%20survival%20rate,the%20lymph%20nodes%20is%2099%25.&text=The%20five%2Dyear%20survival%20rate%20for%20melanoma%20that%20spreads%20to,and%20other%20organs%20is%2030%25.

[11] https://www.aad.org/public/diseases/skin-cancer/types/common

[12] https://www.cancercenter.com/cancer-types/skin-cancer/treatments/surgery#:~:text=Skin%20cancer%20surgeries%20may%20result,%2C%20head%2C%20neck%20or%20hands.

[13] https://www.aad.org/media/stats-skin-cancer#:~:text=The%20five%2Dyear%20survival%20rate,the%20lymph%20nodes%20is%2099%25.&text=The%20five%2Dyear%20survival%20rate%20for%20melanoma%20that%20spreads%20to,and%20other%20organs%20is%2030%25.

[14] https://www.cancer.org/cancer/types/melanoma-skin-cancer/detection-diagnosis-staging/survival-rates-for-melanoma-skin-cancer-by-stage.html

[15] https://www.curemelanoma.org/about-melanoma/melanoma-staging/melanoma-survival-rates

[16] https://www.hhs.gov/surgeongeneral/reports-and-publications/skin-cancer/executive-summary/index.html

[17] https://www.hhs.gov/surgeongeneral/reports-and-publications/skin-cancer/executive-summary/index.html

[18] https://www.thelancet.com/pdfs/journals/lanonc/PIIS1470204502006794.pdf

[19] https://www.aafp.org/pubs/afp/issues/2008/0915/p704.html

[20] https://dermnetnz.org/cme/dermoscopy-course/dermoscopy-of-melanoma#:~:text=It%20can%20also%20be%20missed,may%20be%20distributed%20fairly%20symmetrically

[21] https://www.pennmedicine.org/news/news-releases/2019/april/topical-targeted-therapies-show-promise-in-treatment-of-skin-cancer

[22] https://pubmed.ncbi.nlm.nih.gov/8923396/#:~:text=Conclusions%3A%20Among%20the%20skin%20lesions,and%2010.0%20percent%20were%20malignant.

[23] https://www.theinsightpartners.com/reports/skin-cancer-diagnostics-market#:~:text=The%20non%2Dmelanoma%20segment%20dominated,share%20of%2052.31%25%20in%202021

[24] https://www.who.int/news/item/22-07-2002-helping-people-reduce-their-risks-of-skin-cancer-and-cataract

[25] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10707690/

[26] https://www.startengine.com/offering/vitaimaging